Lease net present value calculator

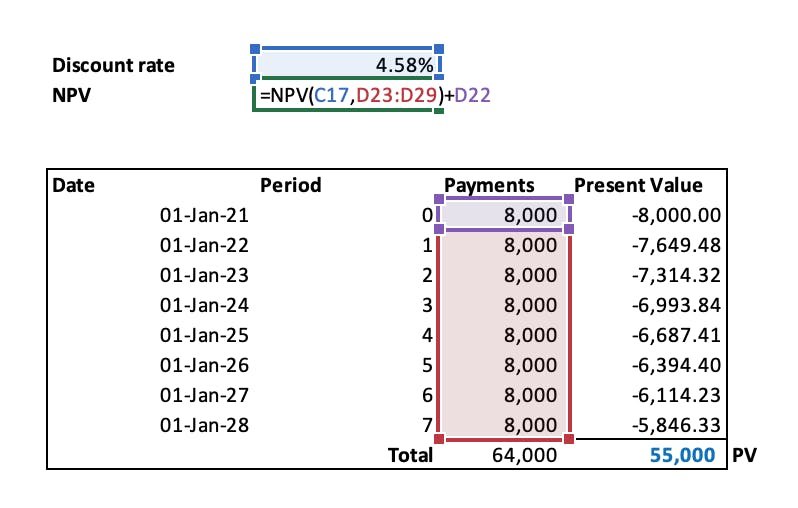

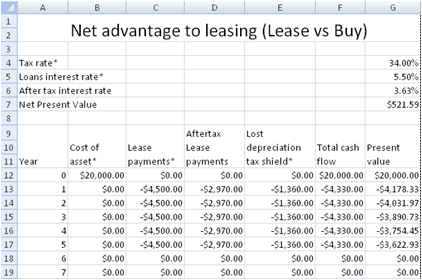

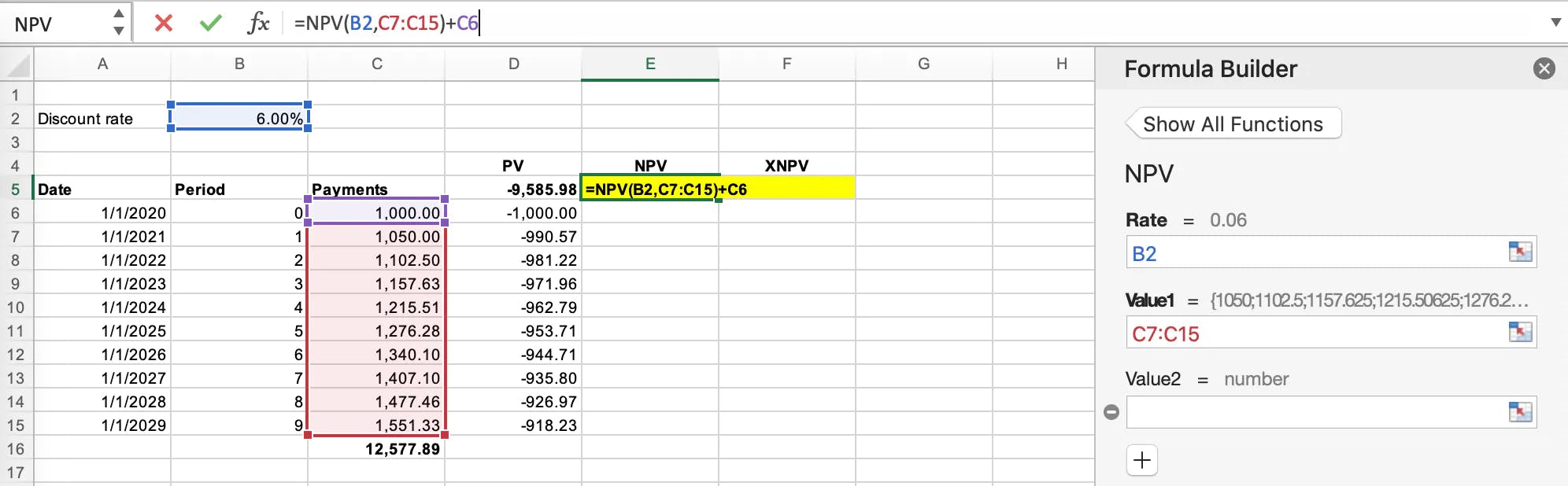

Calculate the net present value NPV of. Formula and Steps to Calculate Net Present Value NPV of Lease Accounting and Analysis.

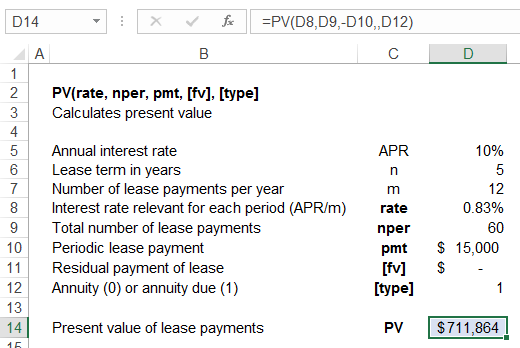

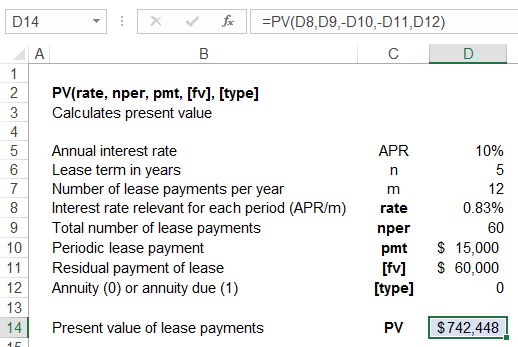

How To Calculate The Present Value Of Lease Payments In Excel

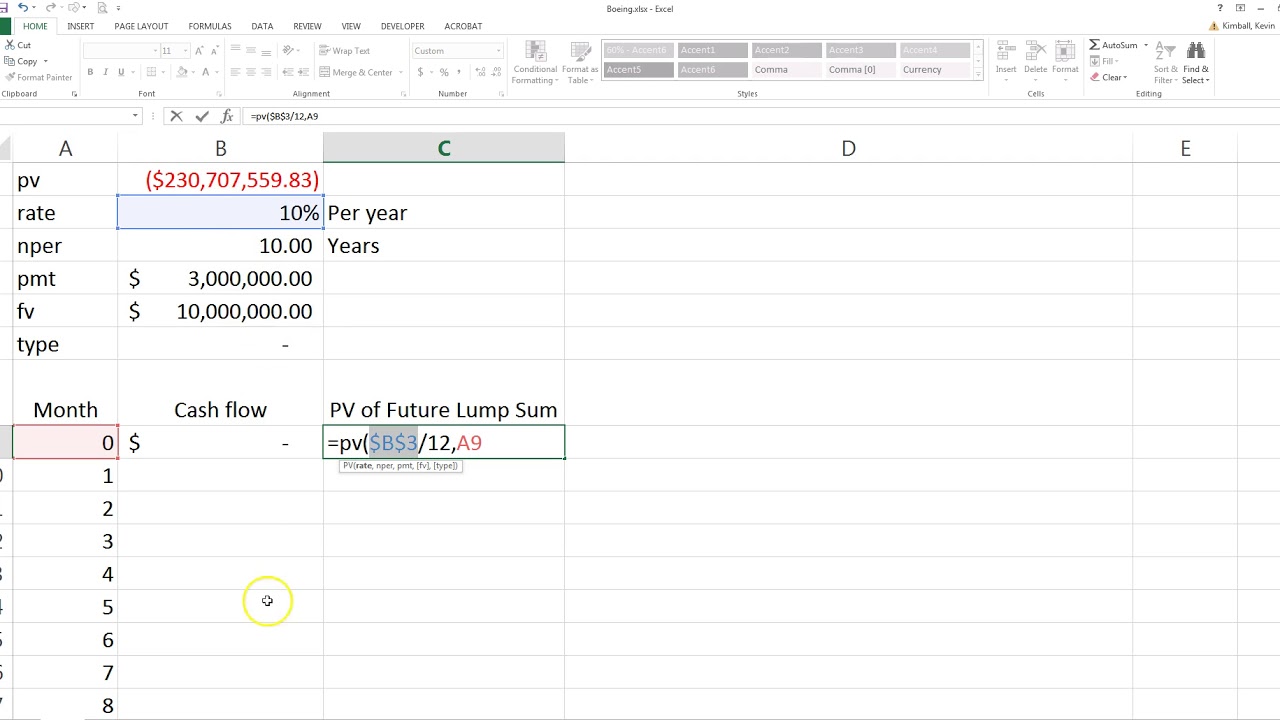

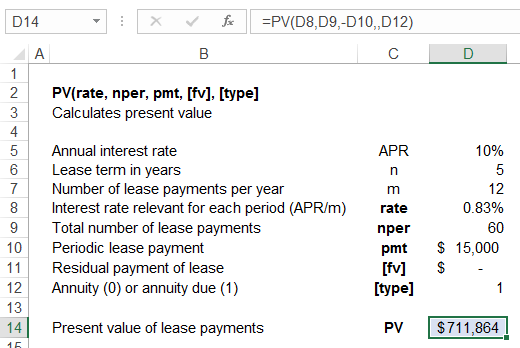

PV Present value also known as present discounted value is the value on a given date of a payment.

. C Cash Flow at time t. PV FV 1r n. That includes the annual discount rate the periodic discount rate.

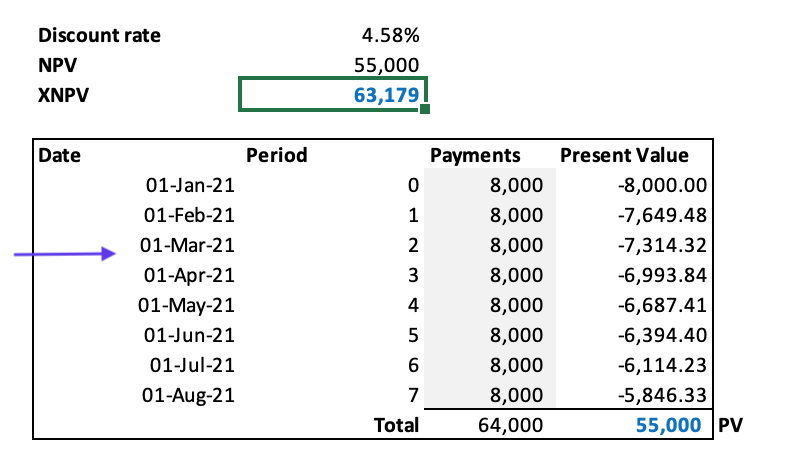

Less Net Cash Out Flowt0 1rt0. This computed value matches that obtained using. In order to calculate NPV we must discount each future cash flow in order to get the present value of each cash flow and then we sum those present values associated with each time period.

LBTT is a self-assessed tax and therefore Revenue Scotland does not accept liability for the use by taxpayers or agents of. 1 The NPV function in Excel is simply NPV and the full formula requirement is. Then to compute the final NPV subtract the initial outlay from the value obtained by the NPV function.

Capitalize your leases based on the present value of lease payments. NPV Net Cash In Flowt1 1rt1 Net Cash In Flowt2 1rt2. Now you can input your lease data.

In this example if you purchase the residential lease in the period between 8 July 2020 to 30 September 2021 you. FV This is the projected amount of money in the future. To calculate the net present value NPV of rents for SDLT purposes-Find the amount of rent payable in respect of each of the first five years of the term of the lease or for each year of the.

It is most commonly associated with car leasing. Where t time period in this case year 1 year 2 and so on. Pay SDLT on 55000 at 1.

All of this is shown below in the present value formula. As an example a car worth 30000 that is leased for 3 years can have a residual value of 16000 when the lease ends. More specifically you can calculate the present value of uneven cash flows or even cash flows.

The payments required over the lease life aka the lease term. R discount rate expressed as a decimal. This company has set its goal for 5 years and for these 5.

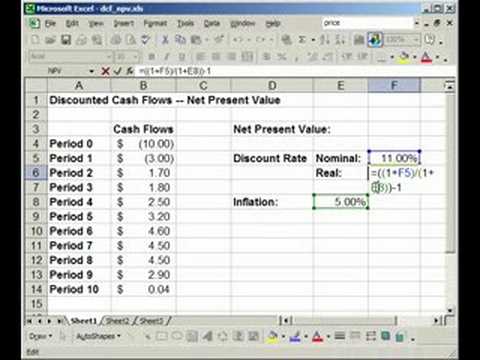

In Excel there is a NPV function that can be used to easily calculate net present value of a series of cash flow. Calculate NPV with Example. Suppose a company wants to start a new manufacturing plant in the near future.

If you wonder how to calculate the Net Present Value NPV by yourself or using an Excel spreadsheet all you need is the formula. R the periodic rate of return interest or inflation rate also known as the discounting rate. A popular concept in finance is the idea of net present value more commonly known as NPV.

After downloading our Present Value Calculator Template above youll find that the excel headers and formulas are already created for you. The commencement of the payments aka the commencement date of the lease. Ad Calculate Payments Yields Commissions and more.

From a lease accounting perspective three main inputs need to be extracted to be able to calculate the net present value calculation of the lease liability. NPV 722169 - 250000 or 472169. NPV net present value.

The company is looking forward to invest a total sum of 100000 in its setup at the beginnning where the expected discount rate is 10 percent per-annum. For example with a period of 10 years an initial investment of 1000000. A lease agreement can be very long and convoluted.

It is important to make the distinction between PV and NPV. If you havent done so already download the Excel File linked in the image above. Net Cash In Flowtn 1rtn.

Verify rate factors more. Residual value is not exclusive to car leases but can. R discount rate or return that could be earned using.

Residual value sometimes called salvage value is an estimate of how much an asset will be worth at the end of its lease. The tax calculator allows taxpayers and agents to work out the amount of LBTT payable on residential non-residential or mixed property transactions and non-residential lease transactions based on the rates and thresholds. Add this to the amount of SDLT due on the premium.

While the former is usually associated with learning broad financial concepts and financial calculators the latter generally has more practical uses in everyday life. Calculate the present value of lease payments for a 10-year lease with annual payments of 1000 with 5 escalations annually paid in advance. Where r is the discount rate and t is the number of cash flow periods C0 is the initial investment while Ct is the return during period t.

T time period.

Calculating Present Value In Excel Function Examples

Compute The Present Value Of Minimum Future Lease Payments Youtube

How To Calculate The Present Value Of Lease Payments Excel Occupier

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Discount Rate Implicit In The Lease

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Npv Calculator Irr And Net Present Value Calculator For Excel

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Discount Rate Implicit In The Lease

What Is The Net Present Value Npv How Is It Calculated Project Management Info

Get The Net Present Value Of A Project Calculation Finance In Excel Npv Youtube

Free Lease Or Buy Calculator Net Advantage To Leasing

How To Calculate The Present Value Of Future Lease Payments

How To Calculate The Present Value Of Future Lease Payments

How To Calculate The Present Value Of Lease Payments In Excel

Calculate Lease Payments Tvmcalcs Com

Calculating Present Value In Excel Function Examples